November 2016 Market Update

Southeast Michigan

Spotlight on Detroit

Over the past few years, all the talk about and focus on Detroit has been exciting. Everyone is cheering for our city and so many want to participate in Detroit’s comeback. We are still in the early stages of residential reconstruction but the shortage of quality residential inventory continues to restrict progress.

Investors like Dan Gilbert have initially focused on commercial development. The idea was that the first step in rebuilding the city was to start with the economic base. Businesses have been returning to the city with a concentration on Downtown and adjacent areas. This has created a significant new demand for residential development—especially in core areas around Downtown and Midtown.

Many of Detroit’s residential properties experienced over 40 years of neglect. It will take time to restore properties that are financially worth keeping and to redevelop new properties.

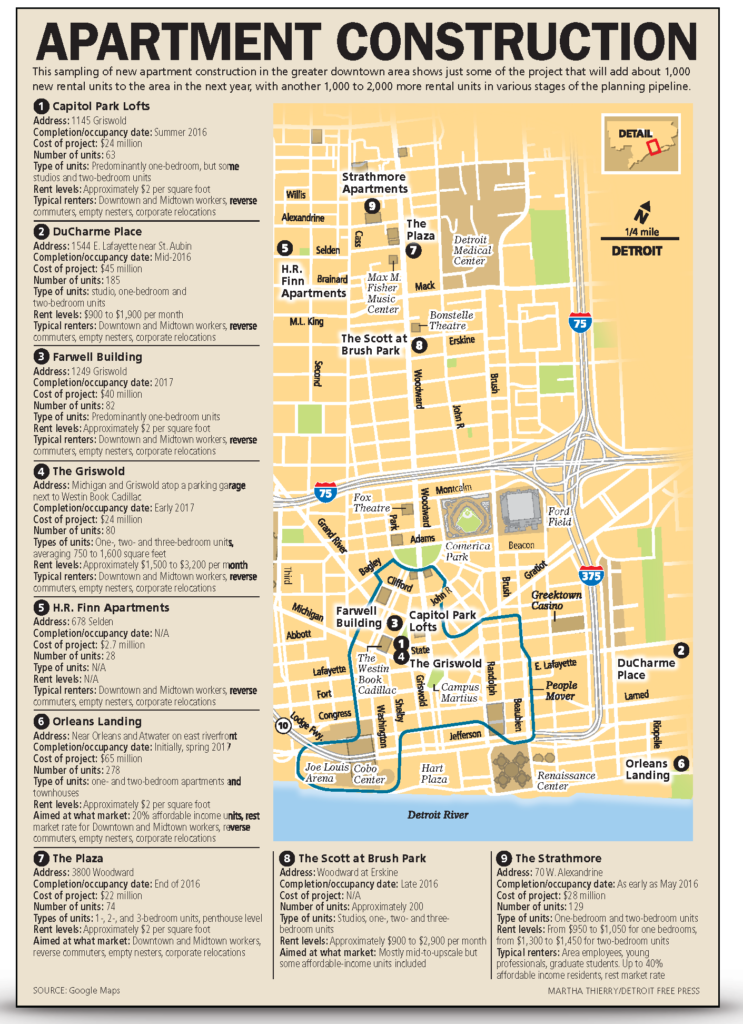

There are currently more than 1000 new apartments under construction in Detroit. Many are just coming online and will probably start out as rentals with the intent to eventually convert them to condos.

In the meantime, we are in the business of selling homes and there just isn’t enough quality inventory in the core neighborhoods to meet demand. Millennials are looking to establish urban roots and many empty-nester Baby Boomers are looking to trade in their homes for urban condos and lofts. People want to leave the car in the garage in favor of public transportation, walking and cycling to where they work and play.

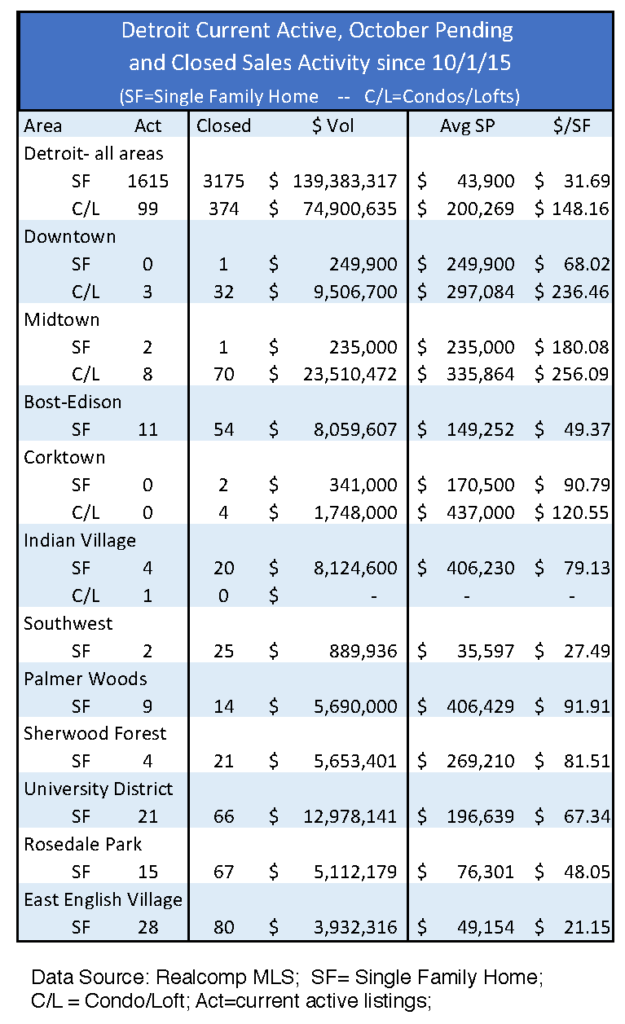

Detroit currently has 1,615 available single family homes ($85 million) and 99 condos ($21 million). Since October of 2015 Realcomp MLS shows 3,175 Detroit single family home sales with an average sale price of $43,900 and 99 condo/loft sales with an average price of $200,269.

Some Core Detroit Neighborhoods:

Downtown is surrounded by the Lodge Fwy on the west, I-75 on the north, I-375 on the east and the Detroit River to the south. Downtown is primarily commercial and its condo/lofts account for most of its residential property with 32 condo sales with an average sale price of about $300k since October 2015.

Midtown is north of Downtown, with roughly Warren (just south of Wayne State) as its north boundary, John R on the east, I-75 to the south and the Lodge Freeway on the west. Midtown had 70 condo/loft sales and only one single family home sale since October 2015, and the average sale price for a Midtown loft was $336k.

Boston Edison is made up of four east-west streets between Woodward and Linwood. Boston Blvd on the north and Edison on the south. Fifty-four single family homes were sold with an average sale price of $149k since October 2015.

The Riverfront area east of Downtown was a little slower to rebound as buyers were more focused on areas with a higher concentration of walkable restaurants and activities. The riverfront neighborhoods with their proximity to the River Walk and Belle Isle have more recently become popular. They will quickly fill in with new restaurants and shops.

Neighborhoods along the river have great potential to skyrocket in value as you can can build restaurants along the riverfront areas, you can’t add a riverfront to other neighborhoods.

The table below shows sales activity for a few other Detroit specialty neighborhoods.

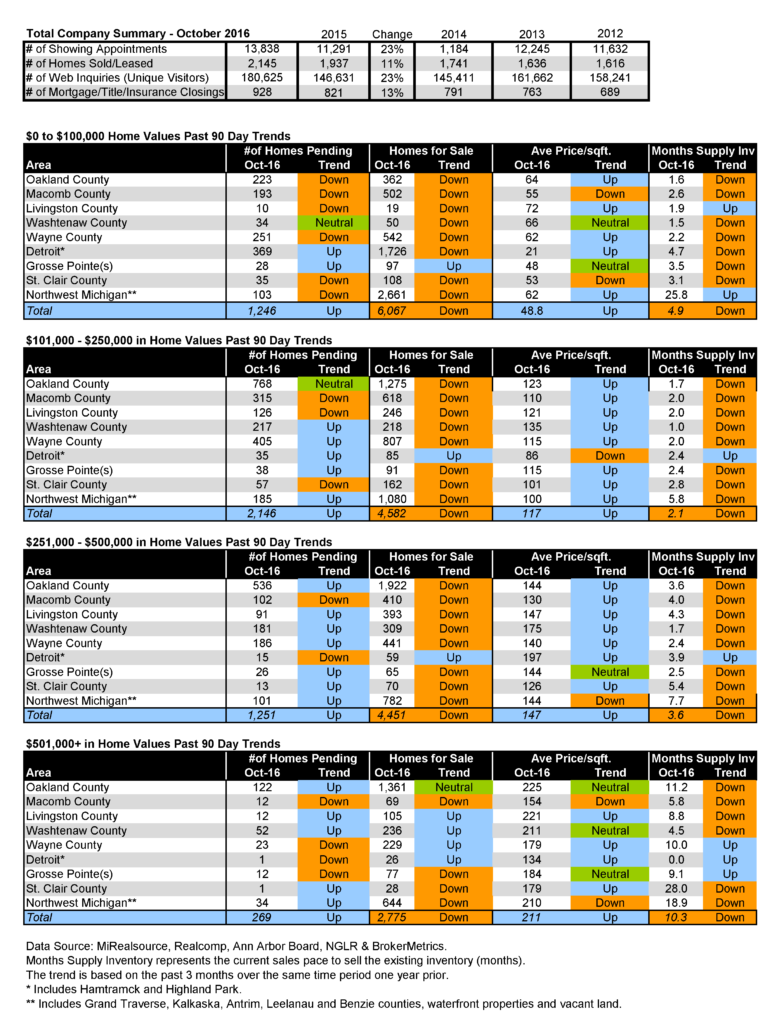

Quick Southeast Michigan October 2016 Activity Summary

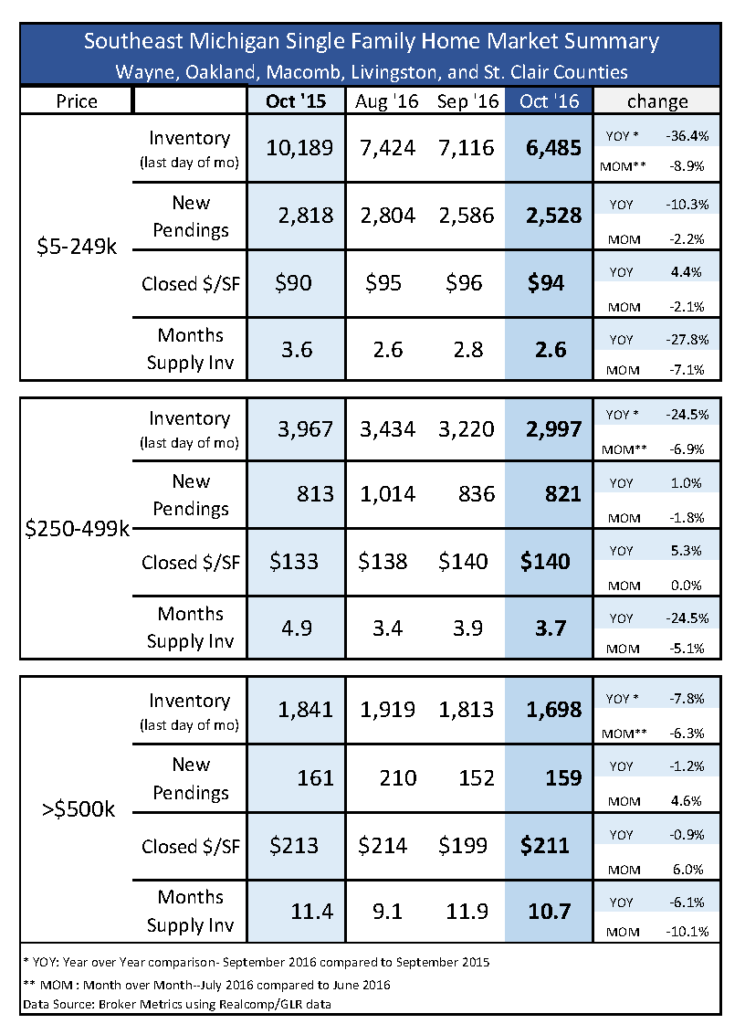

Despite seasonal inventory levels dropping, the number of new pending sales remained level from September into October—across all price ranges. The average sale price in October of 2016 ($210k) is ten percent higher than in October of 2015 but the overall number of new pending sales dropped almost eight percent.

Comparing values (all price ranges combined) from October closings to sales last October, median closed price ($169k) is up nine percent, average sale price ($210k) is up 10.5 percent and closed dollar per square foot rose eight percent from $113 to $122.

With less than four months of available inventory in the $250k to $500k price range and less than three months of the supply in the “under $250k price range, homes in both of those price ranges continue to move. But for homes priced above $500k, supply levels nearly triple to over 10 months of available inventory.

Sellers in the higher end markets face tighter competition and higher buyer expectations. Sharp preparation and pricing are key to successful selling in all price ranges — more so with upper-end sales.