Many consumers are questioning, “Where are we in our housing recovery? At the middle? End? Or are we even heading towards another bubble?” Let’s take the “bubble” question first. The potential bubble is rooted in the strength of the overall economy and housing leverage (mortgage balances getting ahead of home values). The indicators we watch for in terms of core economic factors can be evaluated based on the following questions: “Are jobs and household income growing?” For Michigan, “Are auto sales still strong?” “Is consumer confidence and spending still strong?” “Are there international or other factors that could slow the general economy?” The answers to all of those questions are “yes” at the moment, save the international or “other” factors, which present as a wild card for the US, and the rest of the world as well (the silver lining in Brexit is even lower interest rates).

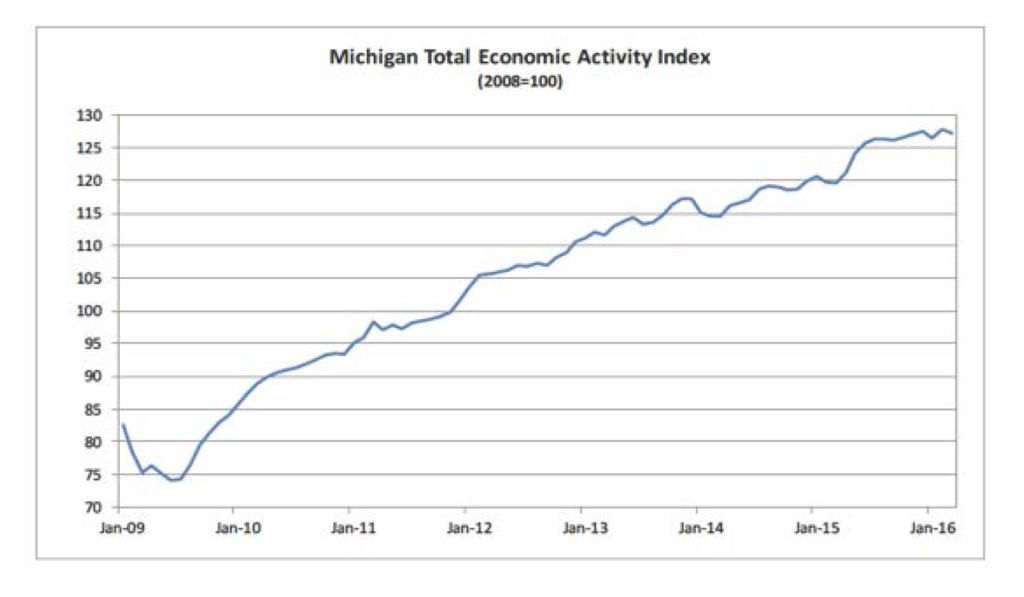

Michigan is still one of the top states in terms of economic activity and there are few current economic factors that could cause a housing slowdown for the next 12-18 months (just international issues and the Presidential election). The chart below from Comerica shows that Michigan economic activity continues to move in the right direction.

So that leaves the questions: “Where are we in the overall housing recovery?” and “What does the current housing leverage look like?” Mortgage delinquencies continue to fall and have returned to pre-recession levels and mortgage underwriting remains tough, so homeowners are not getting themselves in trouble with mortgages or home equity loans they can’t manage. Housing has out-performed the rest of the economy for much of the recovery but it is logical that once the pent-up activity that was held back during the recession has been released, housing activity will settle back to match the rest of the economy, which has experienced slow but steady growth. We expected to start to see that slowing trend in 2016, but so far the strong spring market has shown us that there is still some pent-up activity yet to be released. The upper-end price ranges have begun to settle back down, but the rest of the markets are still strong.

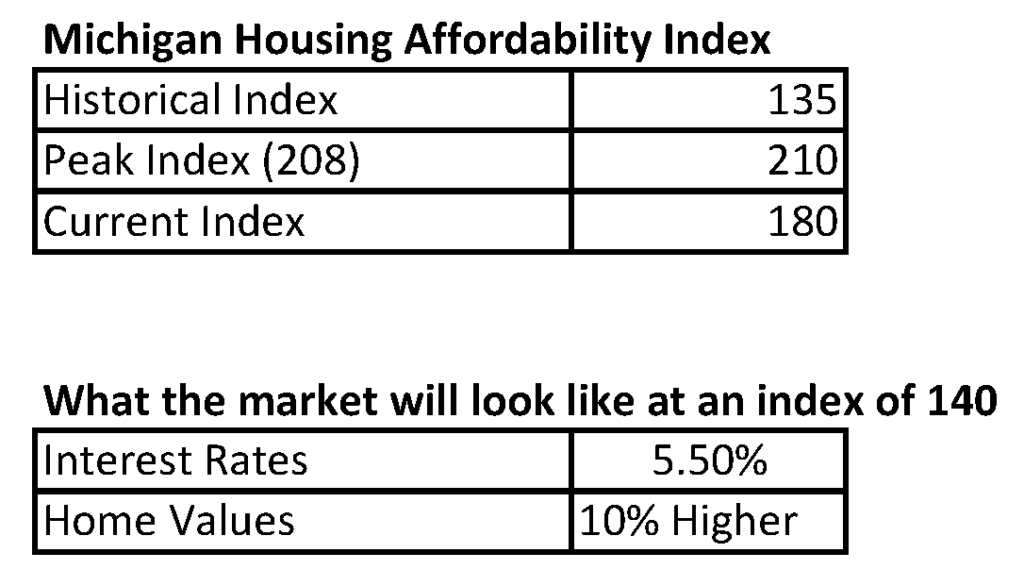

The Housing Affordability Index is a good tool to judge what stage we are at in the recovery. An Index number of 100 shows that the median family can afford the median home. An index of 80, like much of California, means the median family could not afford to purchase their own home. In Michigan our Affordability Index has traditionally be around 130, so Michiganders could comfortably afford their home with some room to spare. With the recession the index jumped to over 200, which is why, once consumers gained confidence, with a combination of low prices and interest rates, the housing market exploded. The index for Michigan is still over 180, which shows there is excess buying power for buyers and therefore, still some room left in our recovery. When the index moves closer to the historical numbers of 130-140, then housing will settle back to a balanced market.

It is not likely that either rates will rise to 5.5% or values jump by 10% in the next 12-18 months, so there is still some pent up demand to be released, but we are getting to the backside of the recovery.

So enjoy one more spring/summer rush! Buyers be patient but ready to jump (overbidding is still not overpaying in most markets). For Sellers, particularly in the upper-end, be ready to adjust to slower buyer activity as listing inventories out-pace buyer growth.

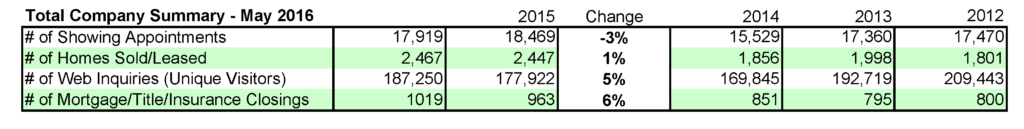

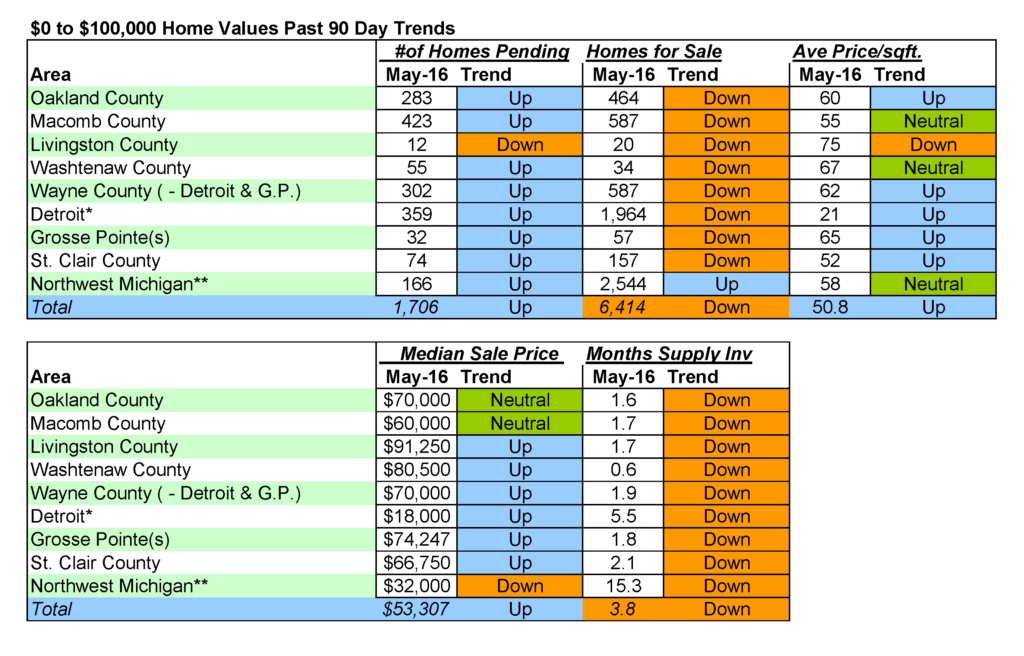

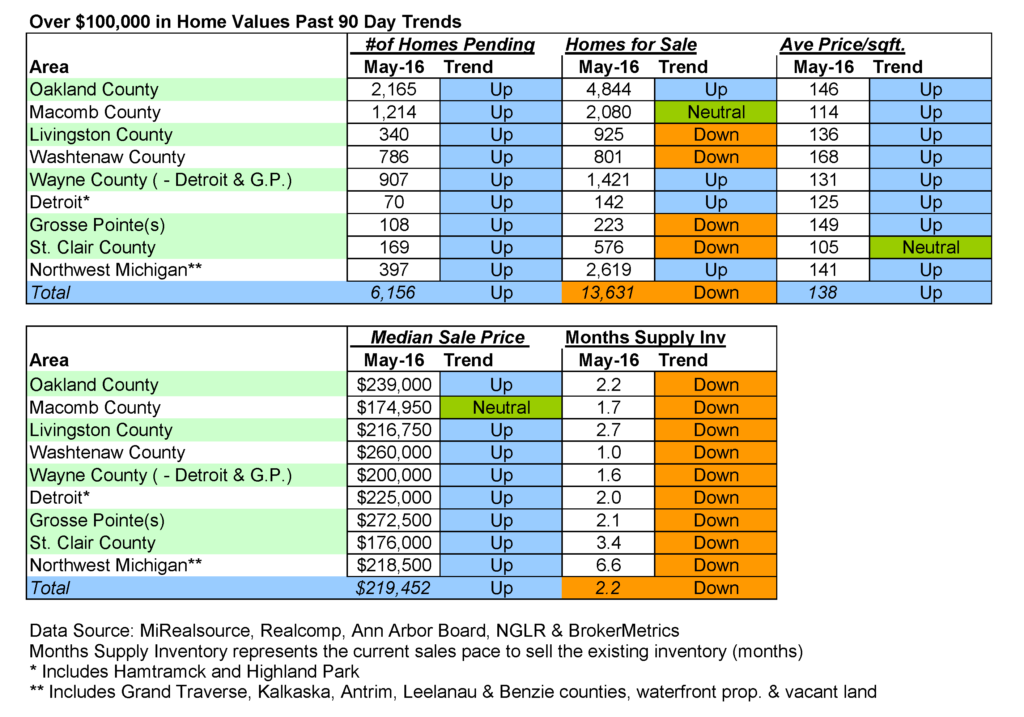

Attached is a market summary by county and price range for a more detailed look at each market.

2020 Year Achievements Flyer

Despite the challenges, 2020 was a great year for our family of companies. Share our accomplishments with your network and clients with this new flyer, featuring our top accomplishments and numbers from 2020. A [...]

What’s New #4 – New Folders & Stationery

What's New 4 - New Folders & Stationery Elevate your everyday communication efforts with personalized stationery and matching folders. All available at GSIprint.com (login and password below). Brand Real Estate One Max Broock [...]

What’s New #3 – Brand & Social Guidelines

Great Brands Build Strong Bonds Complimentary colors and suggested fonts are all compiled in our new brand guidelines. Touching on everything from social media to the new Michigan branding law. Click your brand logo [...]

Email Signature Generator

Make sure your last impression is a great one with our new email signature generator.